It goes without saying that one of the primary objectives of advertising is to increase the profitability of one's business or brand. In addition to putting forward the best strategies to ensure effective advertising , it is equally important to know how to track and quantify how profitable online advertising is, opening the doors to a much more flexible approach.

Return on investment (ROI)

Often known by the acronym ROI , originating from the English terms Return On Investment , return on investment is a key indicator used to assess the profitability of online advertising campaigns.

-

What does a high ROI mean ?

The greater the ROI value, the greater the revenue generated from your advertising investments compared to the costs incurred. A high ROI therefore indicates that the campaign is effective and that it brings you more than what you invest in it. This especially happens when an advertisement effectively reaches its target audience and thus generates conversions. This is why it is important to have a well-targeted advertising strategy, oriented towards generating profits.

-

What does a low ROI mean ?

On the other hand, a lower ROI value implies that the revenue generated by your campaign is lower than the advertising costs paid. This therefore indicates that your campaign is not performing as expected and is not achieving the established objectives.

Although a low value of this indicator can be cause for concern, there are solutions available to you. The first step is to find the cause of the problem: inadequate targeting, lack of conviction in the message presented, offer insufficiently attractive to the public, conversion problem on your website, etc. In some cases, a low ROI may also indicate that your campaign is only focused on building awareness and brand awareness, rather than generating direct revenue. Adjustments can then be made to optimize the profitability of your online advertising strategy .

Return on Ad Spend (ROAS)

Coming from the terms Return On Ads Spend , ROAS can be defined as a specific measure evaluating the return on advertising spending in relation to the revenue generated. This indicator thus plays a key role in the various marketing campaigns put forward by companies in order to promote their brand, their products and/or their services.

-

What does high ROAS mean ?

A high ROAS is generally a positive indicator , because it means that for every dollar spent on advertising, even greater revenue is generated. We can then conclude that advertising campaigns are effective in generating conversions and that the investment in advertisements is therefore profitable .

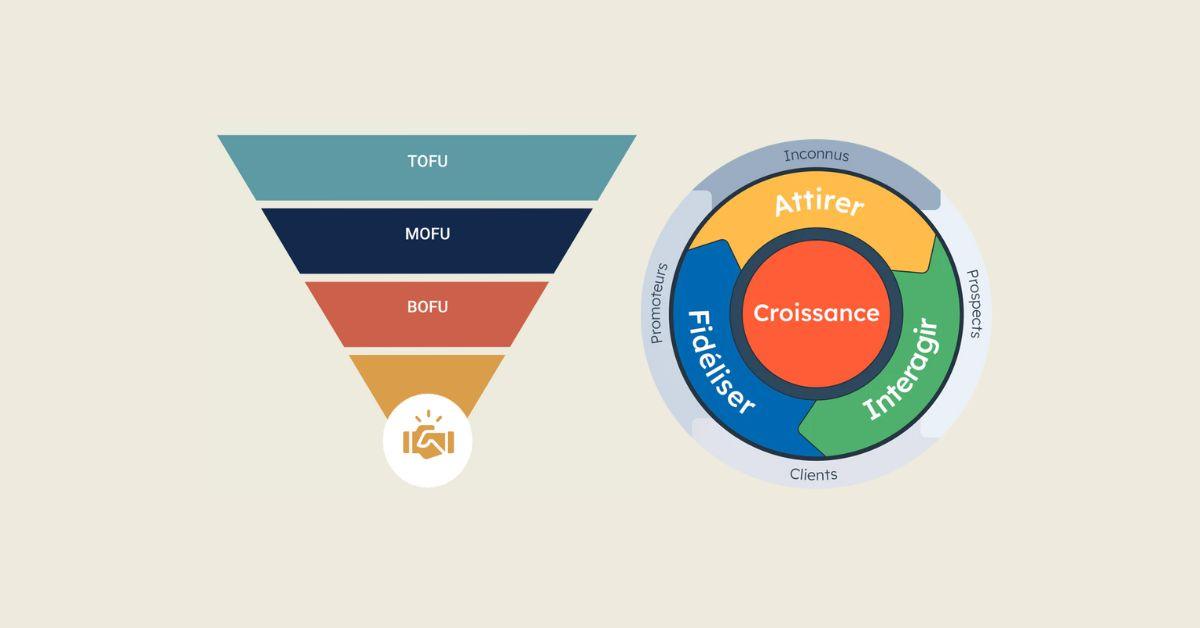

Such a result can be the result of a well-targeted campaign, impactful advertising or a particularly attractive offer for customers. Focusing your advertising efforts on prospects further along the sales funnel can be a good strategy for more frequent conversions and better profitability.

-

What does low ROAS mean ?

On the contrary, when the value of the return on advertising expenditure is low , it means that the income obtained is lower than the amount spent on advertisements. A low ROAS can, for example, result from a poorly targeted campaign, poorly performing advertisements or a poor choice of advertising medium.

The most important thing is to carefully monitor the evolution of these profitability measures , in order to adjust your advertising strategies accordingly with a view to continuous optimization!

The lifetime value of a customer (LTV)

Another key indicator in marketing is what we could call “ customer lifetime value ”. Often identified by the letters LTV (for Life Time Value ), this metric makes it possible to assess the average monetary value that a customer is able to bring to a company over their entire lifespan as an active customer. In other words, LTV represents the total sum of revenue that the company can expect to generate from a single customer throughout its business relationship with that person.

To calculate the Life Time Value of a customer, we generally take into account the average amount that the latter spends during each transaction ( Average Order Value or AOV) and we multiply this value by the average number of purchases made by the same customer over a given period (purchase frequency) and by the average duration of the customer relationship with the company (retention duration).

The formula for calculating LTV is therefore:

LTV = (AOV) x (Purchase Frequency) x (Retention Time)

This metric is particularly relevant in helping businesses understand the true value of each customer over the long term. It also makes it possible to evaluate the effectiveness of loyalty , customer relationship development and retention strategies .

A high LTV is desirable because it means that customers provide significant financial value to the business over a long period of time. Such a result also demonstrates a solid and lasting relationship with customers, successful loyalty and an excellent customer experience.

On the other hand, a low LTV may indicate a problem that needs to be corrected with its advertising strategies. Such a value indicates that customers tend to make one-off purchases but do not necessarily remain loyal to the company over the long term. Obviously, several causes can be at the origin of this situation: customer experience problems, unattractive offers, or even more competitive competitors.

For a good online advertising strategy style="font-weight: 400;" data-mce-fragment="1" data-mce-style="font-weight: 400;">, it is essential for businesses to track and analyze LTV on a regular basis. By understanding the long-term value of each customer, it becomes possible to better adjust marketing investments, optimize advertising costs for new customer acquisition, and focus on actions aimed at increasing customer retention and satisfaction. current. A good analysis of this profitability measure allows you to make informed strategic decisions , thus contributing to the growth of the company.

Maximum Acquisition Cost for a New Customer (CAC)

What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) represents the total cost incurred to acquire a new customer. This includes all marketing and sales costs divided by the number of new customers acquired over a given period. CAC is a crucial metric for evaluating the effectiveness of a company's marketing and sales strategies .

Why is it important to know the maximum acceptable CAC?

Knowing the maximum acceptable CAC is essential to ensure business profitability. If the cost of acquiring a new customer exceeds the value they bring to the business, it can result in financial losses. Thus, defining a maximum CAC helps ensure that marketing and sales efforts are economically viable.

How to calculate the maximum acceptable CAC?

To calculate the maximum acceptable CAC, you must first determine the average customer lifetime value (LTV). CAC should not exceed a significant fraction of LTV to maintain profitability. A general rule is that the CAC should not exceed 1/3 of the LTV for a financially healthy company.

How to reduce CAC?

To reduce CAC, focus on optimizing marketing campaigns to increase their effectiveness, improve the sales process to more effectively convert prospects into customers, and use targeted digital marketing strategies to reach high-quality leads. Marketing automation and data analytics can also help reduce acquisition costs.

What is the impact of a high CAC on a business?

A high CAC can negatively impact the profitability and long-term viability of the business. It says the company is spending too much on acquiring new customers, which can erode profit margins and limit the company's ability to invest in other core areas.

How does CAC interact with other profitability measures?

CAC should be analyzed in conjunction with other metrics such as LTV and ROI. A balance between the cost of acquiring customers and the value they bring to the business is crucial for a sustainable growth strategy. Regular analysis of these indicators makes it possible to adjust marketing and sales strategies to optimize overall profitability.

By integrating CAC into advertising campaign performance analysis, businesses can make more informed decisions on how to allocate their marketing resources to maximize ROI while maintaining healthy, sustainable growth.